e-invoice became an obligation for every business in Egypt, iX ERP has an e-invoice integrated module to send invoices to Egyptian tax authority from inside iX ERP, this documentation “Egypt tax e-invoice setup” will explain how to set up iX ERP integration with Egyptian Tax Authority portal.

Egyptian tax authority has two portals, demo portal and live mode portal, please use the demo portal for testing.

Demo portal: https://preprod.invoicing.eta.gov.eg/

Live portal: https://invoicing.eta.gov.eg/

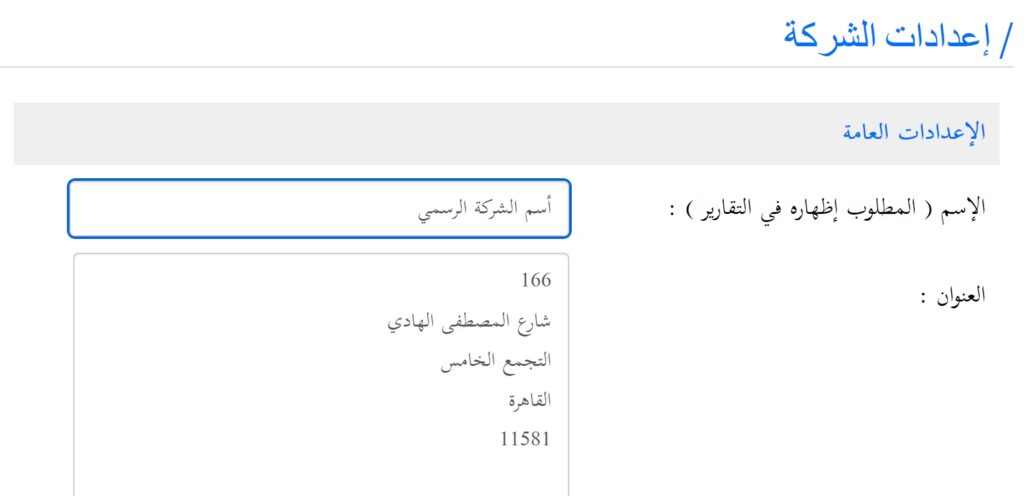

Company Setup

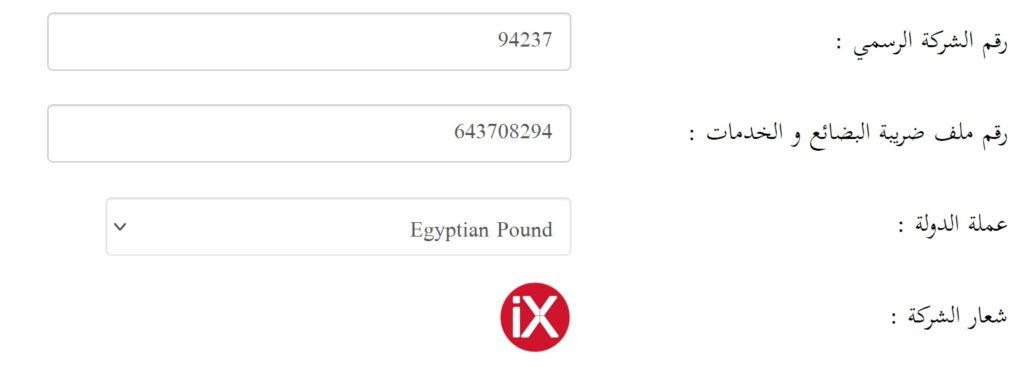

In company setup, from settings->company setup, you need to enter the company information like official company name, company address, company registration number, company tax registration number, please make sure that all company information is matching exactly the Egyptian tax authority records, you can get all information from tax authority portal.

Please follow the company address structure separated by “enter key”, as every item on separate line as per Egyptian tax requirements:

Building number:

Street Name:

Region:

City:

Postal Code:

Please make sure that the company registration number and company tax registration number don’t include any spaces or spacial characters like “-” or “,” (numbers only)

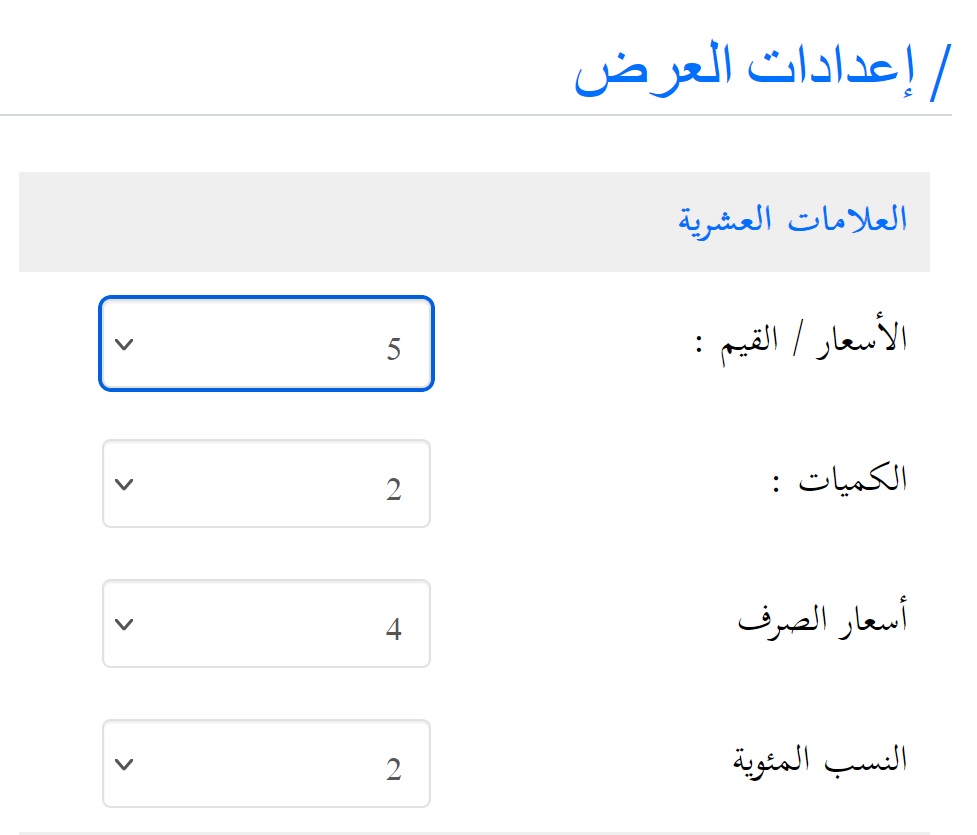

In user’s preferences or company display setup, please set the Price/Amount to 5 decimal points as per Egyptian tax Authority requirements

If you are trading with different currencies, iX ERP as a multi currency system allows you to add currencies under the banking and general ledger basic data setup, please note that Egyptian tax authority has preset currency codes which can be found in the following link: https://sdk.invoicing.eta.gov.eg/codes/currencies/

Tax Configuration

iX ERP supports complex and dynamic tax calculations to satisfy all businesses’ scenarios, The set-up is performed on three stages, tax rates, Tax groups and Tax types, in the following we will go through tax configuration step by step.

Tax Rates Configuration:

As per Egyptian tax authority standard, there are preset code for every tax, it is known as tax types and sub-types, you can find a complete list of tax codes in the following link: https://sdk.invoicing.eta.gov.eg/codes/tax-types/

You should ask your accountant or the tax authority which one of these codes applies to you.

Then, when you have the code and the rate, for example: T1 for value added tax and the rate is 14%, you can enter this information in the Tax rates screen as follows:

in the tax description field, please enter the Egyptian tax authority main tax type code followed by “:” with no spaces, then the tax name or description.

In the tax rate field, please enter the rate without the percentage sign.

In the general ledger fields, you should select the general ledger accounts created earlier, please include at least one general ledger account per tax rate, then save the tax rate, by default all Egyptian tax authority main codes will be included you may make changes to the rate as appropriate.

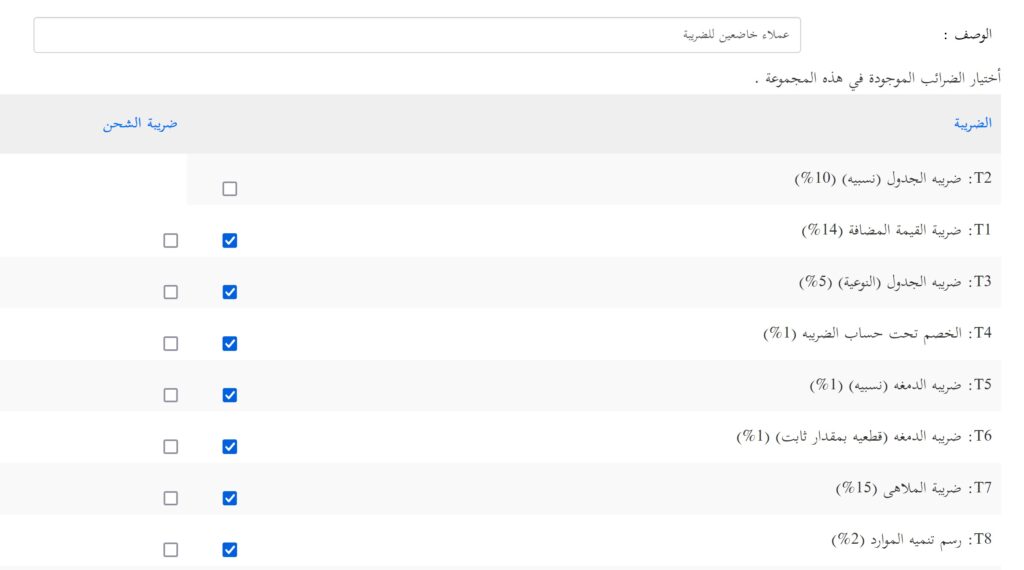

Tax Groups Configuration:

In tax groups configuration, we need to create customer and suppliers groups that tell iX ERP which main tax rates are applied to the group of customers and suppliers, as a default we will include four main groups, tow for customers which are taxable customer and customers exempted from tax and the same for the suppliers, the taxable customer and suppliers group you should select all applied taxes or main tax rates, and as a default we will include all tax rates, and in the tax exempted groups we will not select any tax rates. You can create any special tax group for special tax treatment for customers and suppliers.

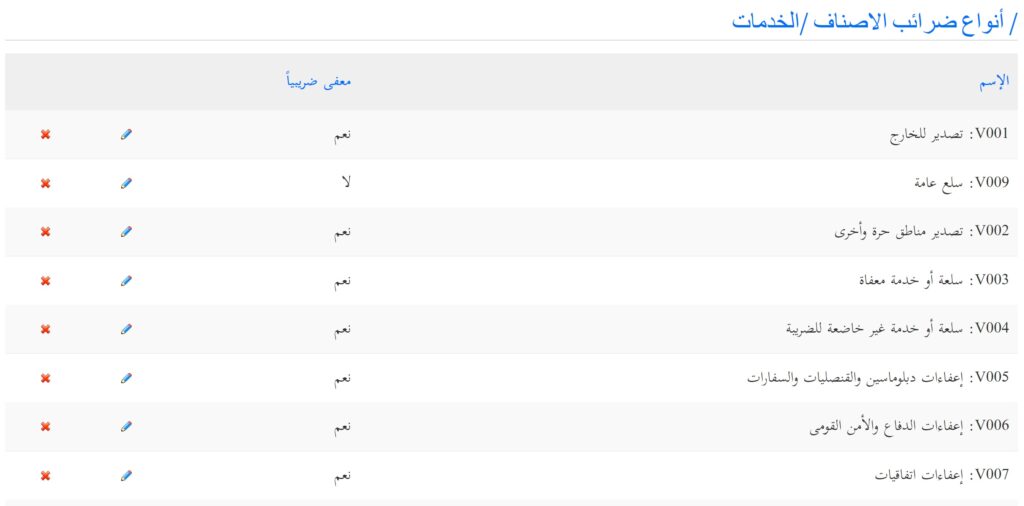

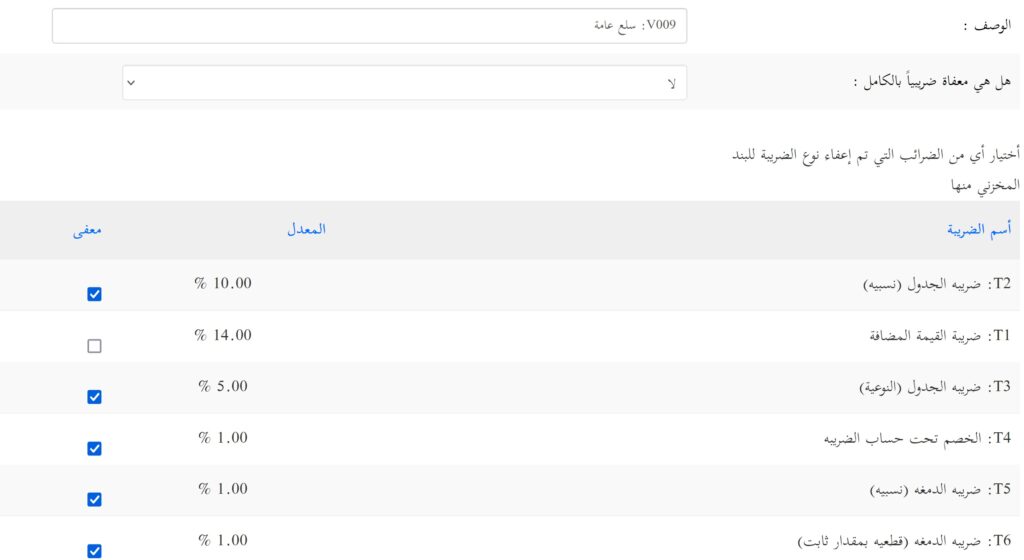

Items Tax Types Configuration:

In this section, we will define items tax types in general it represents the Egyptian tax authority sub-types and can be found in the same tax type codes above, there are two main types of Item tax types which are, fully tax exempted items and taxable items. In the full tax exempted types like for example export items, please select “Yes” for the fully exempted field, then iX ERP will disable all taxes for this type. In the taxable item type, please select “No” for the fully exempted field, and select only the exempted tax rates and leave the ones that apply unchecked, also, please include the tax subtype code in the description field followed by “:” separator then the name of the tax subtype. You should select this subtype in the items/products/services recording later.

Egyptian tax authority and Token Configuration

Under this section Egypt tax e-invoice setup or Egypt Tax module configuration, there are important information that should be filled carefully and can be found under your tax registration portal.

The first field is for defining whether you are working on demo or live mode, please use the Demo mode at the beginning to test the integration with the tax portal.

In the field of Activity type, please enter the Egyptian tax authority preset activity type code with no spaces, a list of activity types can be found in the following link: https://sdk.invoicing.eta.gov.eg/codes/activity-types/

In the field of business type, there are three types of preset codes “B” for business in Egypt and this include most of the companies in Egypt, “P” for person and “F” for foreign companies.

Token PIN, you should have this pin from your Token provider or during Token installation, please note that you cannot send invoices to Egyptian Tax authority without the Token.

The certificate name, you should have the certificate name during the Token software installation, usually, and by default it is the name of the provider, but if you had changed the certificate name, please enter the certificate name exactly as it appears in the token software installation.

To integrate with Egyptian Tax authority portal with iX ERP, you need to have integration client ID and secret key, this can be created from Egyptian tax authority portal under the company profile, under ERP integration, please make sure you save these keys in a safe place as it appears once when you create the integration and cannot be accessed again, please enter this information in its proper fields. Please note, there is a different client ID and secret key for the Demo mode and live mode.

For security, we created a separate user to communicate with Egyptian tax authority, this should not be the same as your user, please create a user with subadmin role and include it in the user field in this screen.

Then save the configuration, you can always return to this configuration and change any value as appropriate.

Please download and install Token integration EXE, no configuration is required, this is required to integrate with your token to generate your digital signature for e-invoice, Egyptian tax authority will not allow you to send e-invoices without the digital signature.

Users and Branches Setup

As per the requirements of Egyptian tax authority, the company should have at least one branch which is the company main branch and its code is “0” zero.

iX ERP as a multi use application, you need to set the permissions for every user and their branches.

In the user creation screen, please use the Full Name field to enter the branch code followed by user real name and separated by “-” with no spaces, ex.: 0-Adam

Customers Setup

When creating e-invoice you need to include customer information as per Egyptian tax authority requirements, like customer tax number, name, address and other information.

In iX ERP you can create customers’ with information once and use it every time you issue an invoice, you don’t need to memorise their tax registration ID and other information.

iX ERP creates a default branch when creating a new customer with the same customer information.

Please make sure that customer Tax registration number is entered as one number with no spaces or special characters.

After you create a customer, you can manage customers’ branches from “Customers Branches” screen to add or change any information.

*Please note, branch name is mandatory for iX ERP and Tax authority

Please make sure that customer address structure is as follows, as per Egyptian tax requirements:

Please note, we are using the mailing address for the tax authority requirements, but it is better to have all addresses the same.

Please follow the company address structure separated by “enter key”, as every item on separate line as per Egyptian tax requirements:

Building number:

Street Name:

Region:

City:

Postal Code:

Egyptian tax authority has preset codes for the customer country ex.: Egypt is “EG”, iX ERP allow you to enter any country code using customer area screen in sales basic data, then you can include it in customer branch screen, you can get a list of all countries codes from this link: https://sdk.invoicing.eta.gov.eg/codes/countries/

Customer type is another code which is preset by Egyptian tax authority to identify the customer type, “B” for business, “P” for person and “F” for foreign, You can enter these codes in customers groups screen, and then you can include it in customer branches information

Tax group is a very important field, and it defines how iX ERP will calculate taxes and send it to Egyptian Tax authority, this field is mandatory in customer branch but can be changed later. Tax group setup is done in general settings -> tax explained above in this documentation “Egypt tax e-Invoice Setup”.

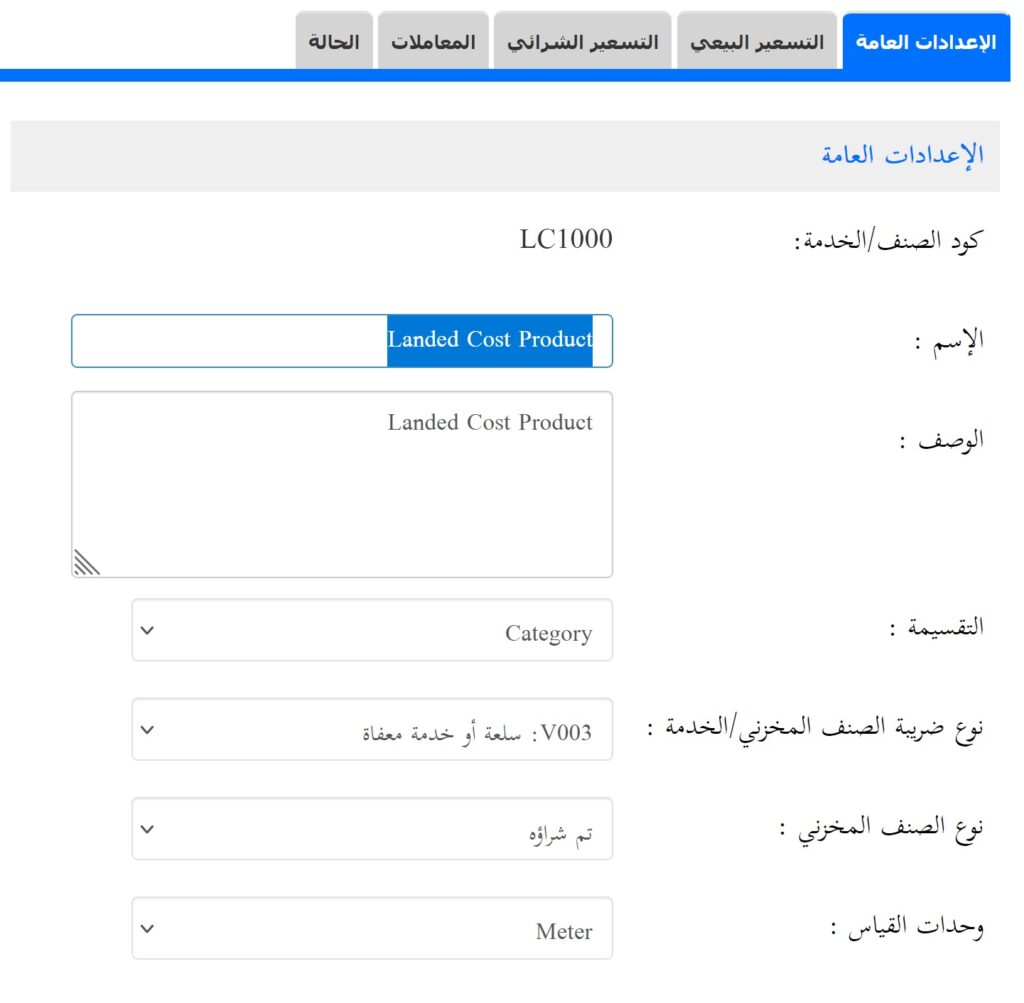

Items / Products / Services Setup

iX ERP allows you to set up your products and services once and use it later for all your invoices, to create a new product or service please enter mandatory fields like product code, name, category, tax type, product or service type, and unit of measurement.

The product Code is your internal product code and not involved in sending invoices to tax authority process, but is mandatory as a unique identifier for your product or service and required to set up EGS and GS1 codes.

The products or services category can be set up from the inventory basic data tab under items categories, you can enter unlimited number of categories and sub categories with items default configuration like unit of measure and general ledger accounts.

Items tax type is mandatory for e-Invoice sending and should be selected, Items tax type can be configured from the iX ERP main setup and will be explained above in this documentation “Egypt tax e-Invoice Setup”.

Units of measure is another mandatory field and can be managed from inventory module under basic data tab, you can enter unlimited measurement units to use it with your products and services, these units to be used with Egyptian tax authority they have to follow the tax authority unit’s preset codes from this link: https://sdk.invoicing.eta.gov.eg/codes/unit-types/

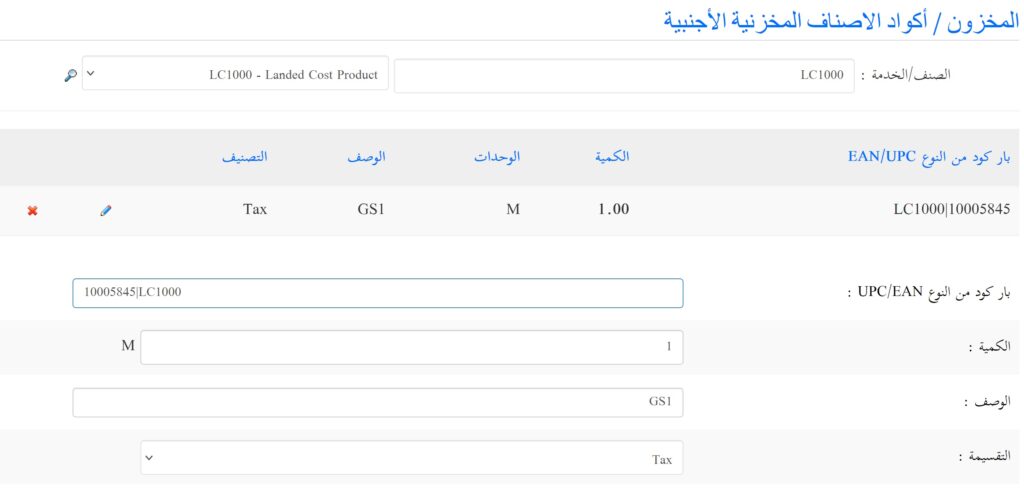

After product or service set up, you can set up the product or service EGS/GS1 codes, using item foreign codes in iX ERP under inventory basic data:

First, select the item that you want to enter its EGS/GS1 code, then enter the code in the field of barcode. If you are planning to use the same EGS/GS1 code for several products, which the Egyptian tax authority allows you to do this, then you have to follow the following structure in the barcode field, first enter the EGS/GS1 code, then the internal product code separated by “|” on the keyboard Shift(\ key) between them with no space ex.: 10005845|LC1000.

In the quantity field, type 1 as a default.

In the description field, if your code is EGS, then type EGS and if your product code is GS1 then type GS1, you can search a list of GS1 codes using this link: https://gpc-browser.gs1.org/

The category selection is mandatory to tell iX ERP that this codes will be used with tax authority, you need to create a product category called “TAX” and include it in this field.

This documentation section “Egypt tax e-invoice setup” will be updated if Egyptian tax authority has an update or the application is updated.